For mobile users across Pakistan, PTA taxes have long been a major reason why phones feel unaffordable, especially imported and used devices. In 2026, the government has finally moved to ease this burden by revising phone valuation rules, which directly affects how much PTA-related tax is charged. The result is lower registration costs for many popular smartphones, particularly older flagship models that dominate Pakistan’s market.

This update is already changing buyer behavior and bringing cautious optimism to local mobile markets.

What Exactly Changed in PTA Tax in 2026

The PTA tax reduction in 2026 is not a blanket tax cut. Instead, it comes through updated phone valuation rules, which determine how much duty and PTA tax is charged on imported phones.

Previously:

-

Many phones were taxed based on outdated and inflated values

-

Used phones were treated almost like new ones

-

Taxes stayed high even after global prices dropped

Now:

-

Phone values are closer to current international market prices

-

Older and used models are properly depreciated

-

PTA registration costs for many devices are noticeably lower

This is why users are calling it a “PTA tax reduction,” even though the tax rates themselves were not abolished.

Who Benefits the Most from This Update

The biggest relief is for users who:

-

Buy used or refurbished smartphones

-

Import phones personally from abroad

-

Prefer older flagship models instead of brand-new devices

-

Avoid non-PTA phones due to network blocking

For these users, the difference in PTA registration cost can be thousands to tens of thousands of rupees.

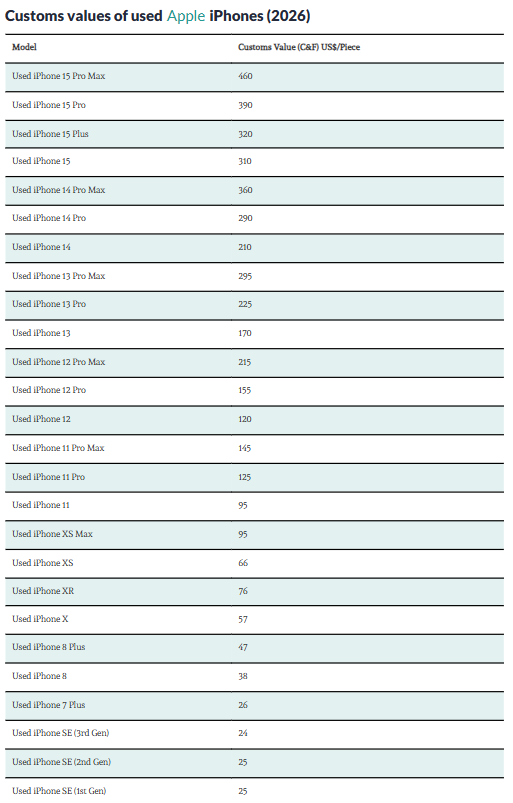

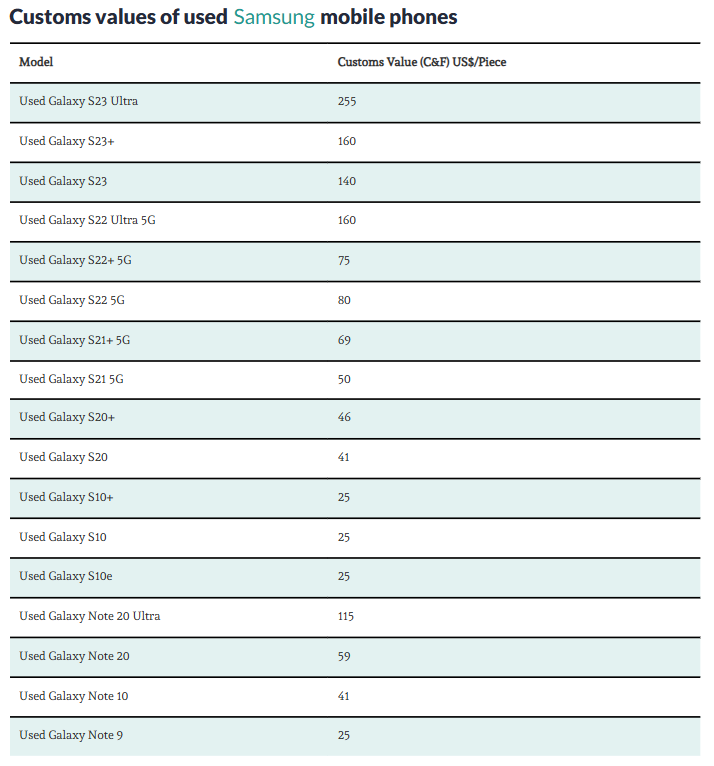

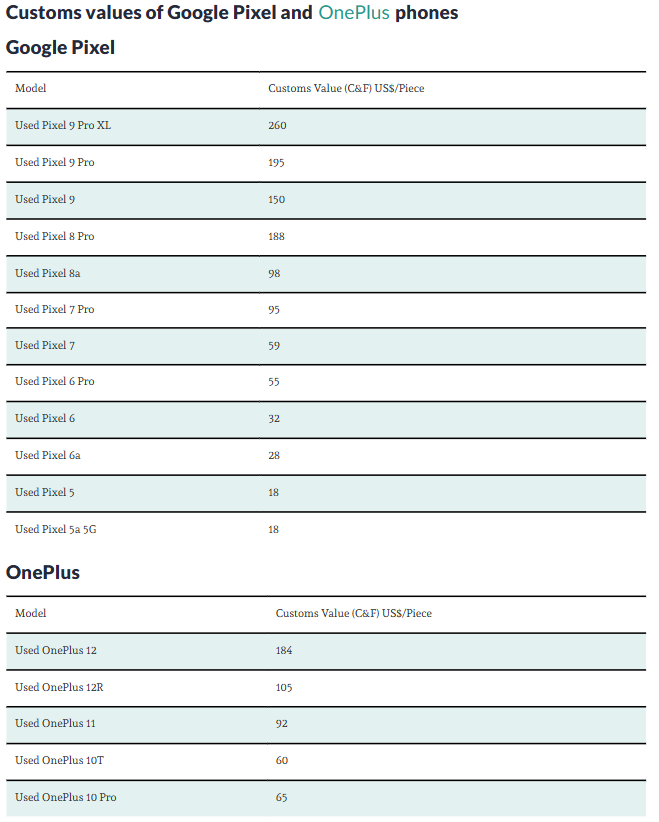

Popular Phones with Reduced PTA Tax (2026 Estimate)

Below is an easy-to-understand table showing indicative PTA tax reduction impact on popular phones. These figures are approximate examples based on revised valuation trends, not fixed official rates. Actual PTA tax may vary by SIM type and dollar rate.

Examples of Phones with PTA Tax Reduction in 2026

| Phone Model | Approx PTA Tax (Before) | Approx PTA Tax (2026) | Estimated Reduction |

|---|---|---|---|

| iPhone 15 Pro Max (used) | Rs. 185,000 | Rs. 150,000 | ↓ Rs. 35,000 |

| iPhone 14 Pro (used) | Rs. 145,000 | Rs. 115,000 | ↓ Rs. 30,000 |

| iPhone 13 (used) | Rs. 95,000 | Rs. 70,000 | ↓ Rs. 25,000 |

| Samsung Galaxy S23 Ultra (used) | Rs. 110,000 | Rs. 85,000 | ↓ Rs. 25,000 |

| Samsung Galaxy S22 (used) | Rs. 75,000 | Rs. 55,000 | ↓ Rs. 20,000 |

| Google Pixel 8 Pro (used) | Rs. 90,000 | Rs. 65,000 | ↓ Rs. 25,000 |

| Google Pixel 7 (used) | Rs. 55,000 | Rs. 38,000 | ↓ Rs. 17,000 |

| OnePlus 12 (used) | Rs. 70,000 | Rs. 50,000 | ↓ Rs. 20,000 |

| OnePlus 10 Pro (used) | Rs. 48,000 | Rs. 32,000 | ↓ Rs. 16,000 |

Note: These are indicative reductions to help users understand the trend. Final PTA tax depends on IMEI, SIM count, dollar rate, and registration method.

Why the Government Took This Step

The earlier PTA tax system created several problems:

-

Legal phones became too expensive

-

Users shifted toward non-PTA or patched devices

-

Grey market activity increased

-

Under-invoicing at import stage became common

By aligning phone values with reality, the government aims to:

-

Encourage legal phone usage

-

Improve transparency

-

Balance revenue with affordability

-

Reduce misuse of the PTA system

This is a correction, not just a concession.

Impact on Mobile Market Prices

Although PTA tax is paid during registration, its effect reaches the consumer market.

What users are already noticing

-

Used phone prices are becoming slightly more reasonable

-

PTA-approved phones are easier to resell

-

Non-PTA phones are losing appeal

-

Buyers are more willing to register devices

Over time, this could stabilize the used-phone market.

Does This Apply to Brand-New Phones

For latest brand-new flagship phones, PTA tax is still high. However:

-

Over-taxation has reduced

-

Depreciation is now handled more realistically

-

Future price drops may reflect faster in PTA charges

The biggest relief remains with used and older models, which is where most Pakistani buyers focus.

Important Conditions Users Should Know

To qualify for lower valuation:

-

The phone should not be brand new

-

Activation history may be checked

-

Condition (A/B grade) does not change fixed valuation

-

Models not listed follow standard assessment rules

Always verify before purchase.

What Mobile Users Should Do Now

If you are planning to buy or register a phone in 2026:

-

Recheck PTA tax before purchase

-

Prefer phones that already show reduced valuation

-

Avoid sellers promising illegal “cheap registration”

-

Keep IMEI and model details verified

A few minutes of checking can save tens of thousands of rupees.

Will PTA Tax Reduce Further in 2026

No further reduction has been officially announced yet. However:

-

Regular valuation updates are now expected

-

Older phones may continue to get depreciation relief

-

Consumer pressure may drive more adjustments

Complete removal of PTA tax is unlikely, but smarter reforms are clearly underway.

Why This Update Matters

Mobile phones are no longer optional. They are essential for:

-

Online education

-

Digital banking

-

Freelancing and remote work

-

Emergency communication

By easing PTA tax pressure, the 2026 update supports digital access, legal compliance, and economic activity.

Conclusion

The PTA tax reduction announced in 2026 marks a meaningful shift toward fairness for mobile users in Pakistan. While taxes still exist, many popular phones now cost significantly less to register, especially used and older flagship models.

For buyers, the message is simple: check updated PTA values before buying. With informed decisions, owning a PTA-approved smartphone in Pakistan is finally becoming more practical—and far less painful—than it was before.

Latest Updates